[ad_1]

It is hard to tell what constitutes a healthy cannabis market in Canada. Retail store numbers vary by province significantly, and the topic of “how many cannabis stores is too many” permeates the country.

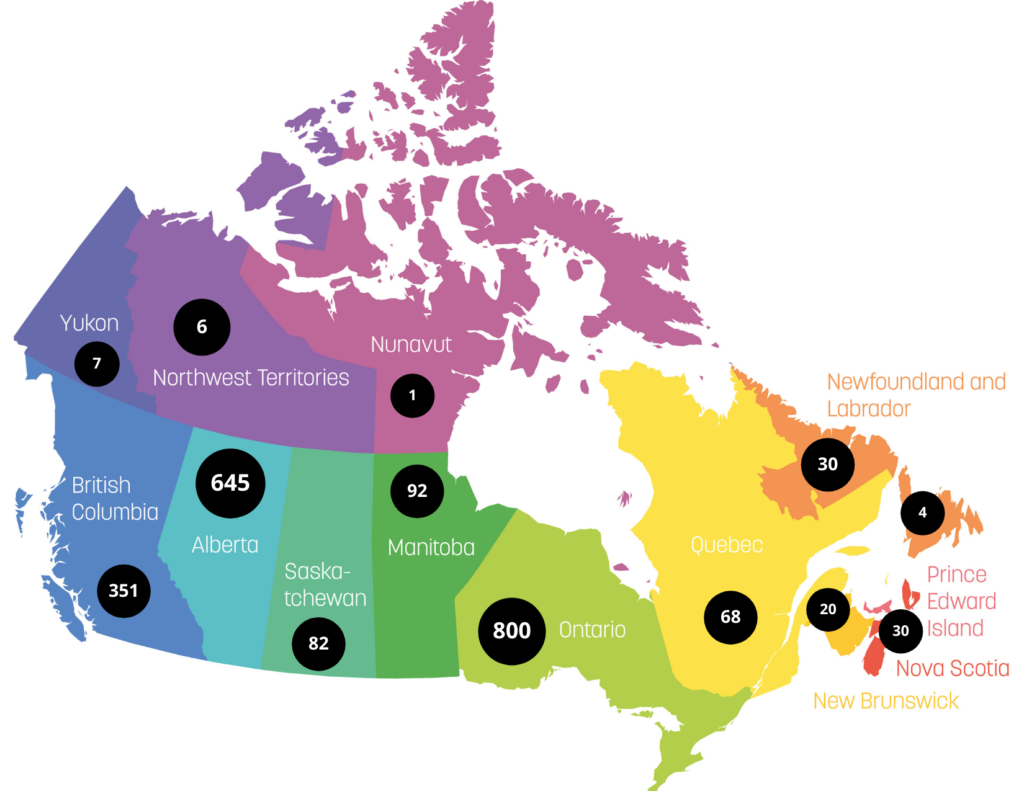

Part of the problem is that while Canada is federally legal, its provinces control retail sales and are varied in their approaches. Ontario, Alberta, and British Columbia are leading the pack in number of stores and other provinces are quickly gaining ground.

Ontario reaches 800 stores and counting

The Ontario Cannabis Store (OCS) announced that the province has reached 800 licensed retail stores. With the highest density of cannabis retail stores in the country, municipalities are hesitant to permit cannabis stores in their district.

The number of cannabis stores in Toronto has been a frequent topic of complaint from groups of non-cannabis business owners in neighbourhoods with high concentrations of cannabis retail, and even some previously licensed cannabis retailers.

Politicians are also torn about cannabis retail in their municipalities. Earlier this month, councillors for the Toronto suburb of Mississauga—Canada’s sixth largest municipality—voted 8 to 4 to continue to allow the opting out of cannabis retail in their city.

Mississauga is not alone in this approach: It’s shared by nearly 70 other municipalities across Ontario, including adjacent Toronto suburbs Markham (pop. 328,966), Vaughan (306,233), and Richmond Hill (195,022).

However, the greater Toronto area doesn’t have the same objection to cannabis retail. The OCS lists 246 cannabis stores within a 50-kilometre radius of the CN tower, leaving Mississauga totally surrounded.

This isn’t just an issue for Toronto and the surrounding GTA; many provinces struggle with cannabis retail. Quebec, for example, doesn’t allow privately owned cannabis retail and operates its public-sector retailer the SQDC based on achieving legalization goals such as undercutting the illicit market.

Recently Saskatchewan lifted its limit on cannabis retail, which caused the number of stores in Saskatoon to tick upward. At the beginning of this month, the city of 325,000 had 24 stores with 8 more on the way, prompting similar discussions.

How many stores is too many?

There are few existing measures to determine how many cannabis retailers are enough—versus too few, or too many— according to Brock University business professor Michael J. Armstrong.

Armstrong explained there is no one way to determine a healthy number of retailers, since what everyone hopes to achieve from cannabis retail is different.

One measure he cautiously suggests is a comparison to Colorado, which industry watchers have described as an ideal balance of 1 store per 10,000 people. Armstrong doesn’t want to put too much weight on Colorado, however.

“Colorado is a legal island surrounded by states that haven’t legalized, so some of their business is going to be people driving across the border and coming in from out of state. I’m not even sure Colorado has stabilized yet: They’re kind of an unusual situation,” said Armstrong.

“The Colorado model at least is a number, and until we find out what works in Canada, it’s a decent ballpark.”

Alberta is rapidly growing with over 600 stores

Another example of an ideal ballpark might be Alberta, who Armstong said is the fastest province to license stores in a limitless private-sector retail environment. After legalization, said Armstrong, Alberta “fairly quickly got up into the high 400s. They’re now a little over 600 stores. It’s not quite stabilized, but it’s certainly tapered off.”

“They’ve had a few stores closed, but it’s still been a net gain month to month. A little over 500 for a population of a little over 4-million. In the short term at least, there’s a Canadian ballpark, at least for private-sector outlets.”

The Atlantic provinces have reached a balance point, he said, but, “Quebec is not there yet: They’re doing a slow and steady expansion. Alberta is past that point, I’m sure. Ontario still has a ways to go.”

Clustering might not be all that bad

When cannabis retail comes up in discussion, the likeliest source of controversy is the issue of clustering, in which cannabis retailers open in close proximity to one another.

Concerned citizens have been worried about neighbourhoods becoming dominated by cannabis retailers long before legalization occurred. While some continue to complain about the issues in certain areas, Armstrong said clustering should not be understood as bad.

“Clustering just happens. We notice it because it’s new: First there’s one cannabis store, and that’s new. Then there’s five! But then you wonder, ‘Where are the coffee shops? Where are the restaurants?’ They’re often clustered.”

“A year from now, Ontario should be around 1,700 to 2,000,” said Brock University business professor Michael J. Armstrong.

The herd will eventually cull itself

The difference between restaurants and cannabis stores is that every restaurant is able to offer something different, such as the style of food or the manner of cooking.

There’s little parallel for that in Canadian cannabis retail, where in most provinces, except Saskatchewan and Newfoundland, retailers must buy from the same pool of products as other retailers.

Standing out from the pack is how cannabis retailers can survive the cull. “That’s also going to be part of a [healthy] ecosystem, when you get that kind of differentiation,” said Armstrong.

Armstrong suspects we will eventually see store closures in Alberta and maybe other provinces as well, cautioning that there are many factors in play: “I think they’re over the number they’ll have in the long-term.”

One factor nobody predicted was the coronavirus.

“People are willing to hang on with mediocre profits while they’re wondering how long this pandemic is going to go on, and whether their competitors will go out of business,” Armstrong said. “My guesstimate is we’ll eventually see that number go down, especially for larger chains.”

The OCS echoes Armstrongs predictions, publishing a ‘year in review’ in which president interim President and CEO David Lobo states “Unfortunately, this rapid growth will likely result in some retailers being faced with increased competition and a crowded marketplace, which could result in some closures and market right-sizing.”

Only time will tell what the future holds for cannabis retail in Canada. Regardless, Canadians should get used to seeing cannabis stores as widely spread out as coffee shops and liquor stores.

By submitting this form, you will be subscribed to news and promotional emails from Leafly and you agree to Leafly’s Terms of Service and Privacy Policy. You can unsubscribe from Leafly email messages anytime.

[ad_2]

Source link